KOTI Insight

RESEARCH

KOTI - Korea Transport institute

KOTI Insight Vol.2 No.1

- Date

January 31 2026

- Authors

나준호

- Page(s)

11 page(s)

Analysis of ESG Practices in the Logistics Industry and Policy Response

Joon-Ho Na

Joon-Ho Na

KEY SUMMARY

ESG - environmental, social, and governance factors - has become an essential pillar of modern management and investment practices. Given its energy-intensive and labor-intensive nature, the logistics industry is particularly affected by the shift toward ESG, making ESG a critical requirement for sustainable growth and stable business operations. Global disclosure frameworks - including the EU’s CSDDD and CSRD, the Carbon Border Adjustment Mechanism (CBAM), the U.S. SEC’s climate-disclosure initiatives, and standards by ISSB and ESRS - are increasingly mandating, standardizing, and integrating environmental and human-rights responsibilities across supply chains. Korea has also introduced climatefocusedsustainability disclosure standards through KSSB in 2024, with phased mandatory reporting beginning in 2025 for listed firms with assets over KRW 2 trillion. This regulatory landscape requires logistics companies to manage greenhouse-gas emissions, strengthen responsibilities related to safety and human rights, and extend oversight to Scope 3 emissions that include partner firms. Accordingly, this study analyzes the current ESG performance of Korea’s logistics industry and identifies government support measures needed to enhance its response capabilities.

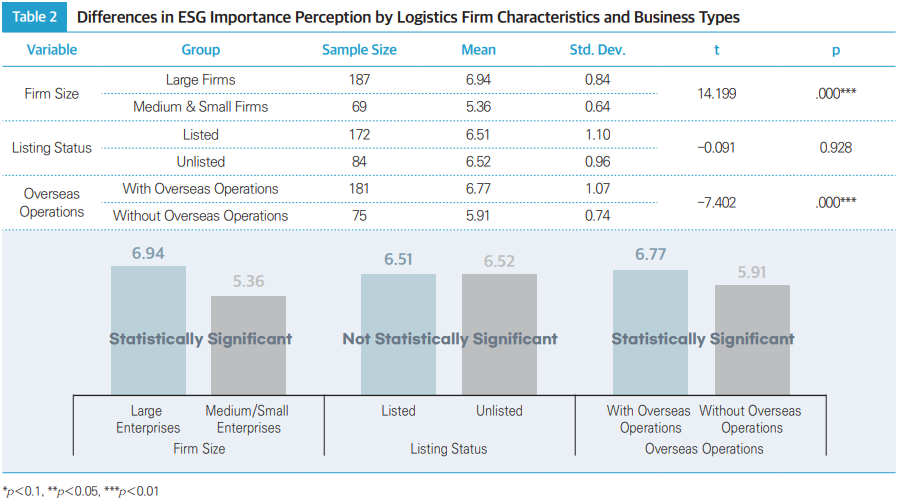

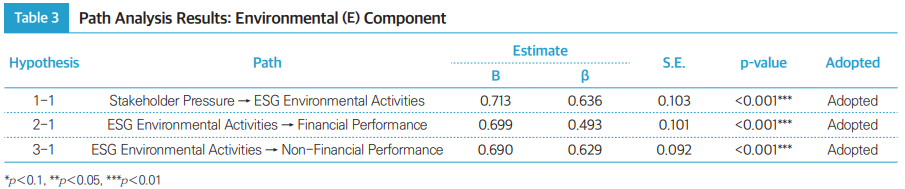

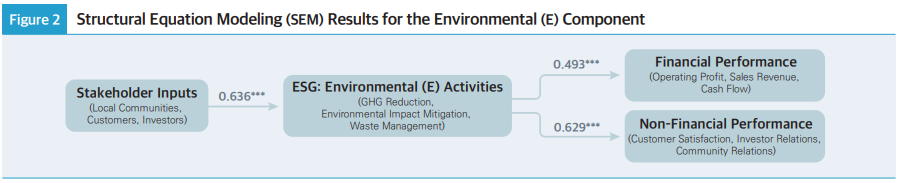

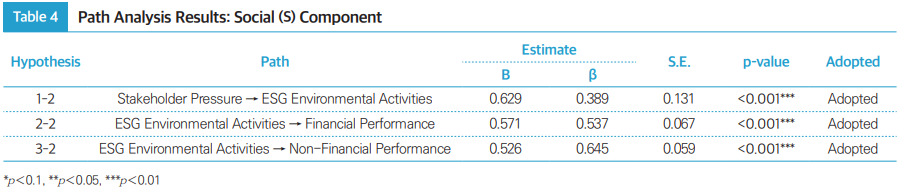

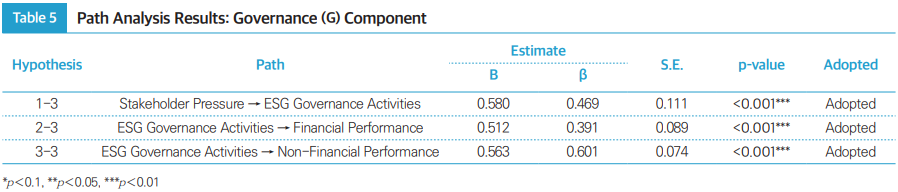

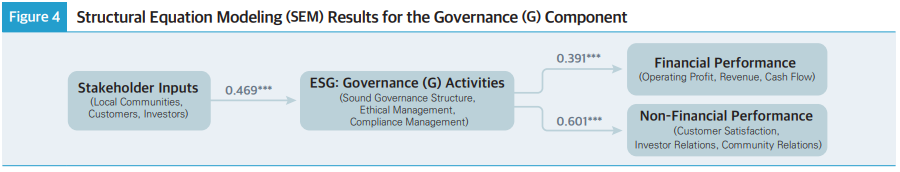

The analysis revealed significant gaps in ESG awareness and readiness. Large firms scored 6.94 compared to 5.63 for small and mid-sized firms, and companies with overseas operations (6.77) outperformed those without (5.91). Environmental (E) efforts - such as reducing greenhouse-gas emissions and mitigating environmental impacts - were found to positively influence both financial outcomes, including revenue, and non-financial outcomes such as investor and customer satisfaction. Social (S) initiatives - including human-rights and safety management and constructive labor-management relations - also contributed positively to financial performance and to non-financial indicators such as community relations and customer satisfaction. Governance (G) activities - such as ethical practices, compliance, and transparent decision-making - were similarly associated with improvements in both financial and non-financial performance.

Based on Korea’s K-ESG Guidelines, the study proposes logistics-specific ESG guidelines applicable to four sectors: integrated logistics, freight transport, warehousing, and forwarding. Ninety-five items across four ESG domains are categorized into “basic” and “advanced” levels, providing detailed implementation pathways by company size and business type, covering carbon management in transport, fleet electrification, energy efficiency in logistics centers, solar and EV-charging infrastructure, workplace ventilation and thermal conditions, eco-friendly packaging and reverse logistics, and Scope 3 supply-chain management.

Government action will determine the pace of ESG adoption. In the short term, the government should establish Scope 1 and 2 guidelines, expand incentives for green packaging and green logistics, strengthen safety and health infrastructure, and build a foundation for environmental management disclosures. In the medium term, it should support the nationwide spread of ESG practices by developing Scope 3 guidelines, verification systems, energy-management infrastructure, solar and charging deployment, and ESG certification schemes. In the long term, policy should accelerate the transition to smart green logistics centers, expand circular-economy and green-logistics R&D, introduce carbon pricing, renewable-energy and clean-transport requirements, advance smart safety management, and strengthen supplier-support funds. The Framework Act on Logistics Policies should be expanded from an “environment-friendly” focus to a broader “sustainability-oriented” framework, while enhancing national governance, certification, disclosure systems, and ESG-aligned workforce development through training and qualification programs. Ultimately, ESG in the logistics sector is not a cost-it is a source of competitiveness. Reducing ESG capability gaps between large and small firms, linking emission- and safety-focused policy support with sector-specific guidelines, and converting regulatory risks into strategic opportunities will be key to securing long-term competitive advantage.

01. Study Overview

As ESG adoption expands across all industries, the logistics sector - characterized by high energy consumption and labor-intensive operations - must engage more proactively in ESG implementation and response. ESG (environmental, social, and governance factors) has become a critical determinant in global investment decisions. As a result, companies are now expected to pursue sustainable development and social responsibility beyond shortterm economic gains. The concept of ESG originated from the 1987 “Our Common Future” report by UNEP and the WCED and was formally articulated in a 2004 UN Global Compact report. The UN subsequently underscored the importance of ESG through the Principles for Responsible Investment (PRI) and the Sustainable Development Goals (SDGs). The Task Force on Climate-related Financial Disclosures (TCFD) also introduced standards to guide corporate risk management regarding climate change.

ESG has become a core component of contemporary business management and investment practices. Consequently, a firm’s ESG performance now serves as a key indicator of its sustainability and long-term growth potential. ESG management has become essential for responding to environmental change and social expectations, and its importance continues to rise as investors and consumers increasingly demand strong ESG practices. Global credit rating agencies are incorporating ESG factors into their evaluations, and institutional investors are integrating ESG considerations into investment decisions. Consumers also

place greater value on ESG when purchasing products, with a growing share intentionally avoiding companies with poor ESG performance. Global asset managers and rating agencies are integrating sustainability assessments into investment processes, and companies that neglect ESG are increasingly likely to face reduced valuations and higher financing costs. With governments advancing carbon-neutrality policies and global ESG regulations tightening, ESG

has become a mandatory consideration across business operations, and the logistics industry faces considerable direct and indirect risks if it fails to prepare adequately. ESG management is no longer optional but an essential business strategy, and regulatory expectations worldwide are becoming even more stringent. Therefore, this study analyzes the current ESG landscape of the Korean logistics industry within this evolving management environment and identifies government policy measures needed to strengthen its capacity to respond.

"ESG (environmental, social, and governance factors) has become a critical determinant in global investment decisions.Consequently, a firm’s ESG performance now serves as a key indicator of its sustainability and long-term growth potential."

02. Domestic and International ESG Regulatory Landscape

The EU’s Corporate Sustainability Due Diligence Directive (CSDDD) requires companies to identify actual and potential adverse impacts on human rights and the environment, take measures to prevent, mitigate, or eliminate them, and disclose relevant information.

The directive applies across all sectors, and due-diligence obligations extend to both EU and non-EU companies depending on their employee count and revenue thresholds. Covered companies must assess risks to human rights and the environment across their entire supply chains, take appropriate corrective actions, maintain grievance-handling mechanisms, and publicly disclose their due-diligence processes.

CSDDD works in conjunction with the Corporate Sustainability Reporting Directive (CSRD), which mandates ESG disclosures for large companies, and EU member states are currently incorporating these requirements into national legislation. Member states determine their own penalty frameworks for non-compliance, which may include not only fines but also non-financial measures such as exclusion from public procurement, distribution bans, or

export restrictions. Following its enactment, member states have two years to transpose the directive into national law, with full application to firms occurring three to five years later depending on company size.

The European Commission also introduced the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage and protect the competitiveness of EU industries. The scheme aims to prevent high-carbon products from less regulated countries from replacing EU goods and to narrow cost differences arising from uneven global climatepolicy stringency. Starting in 2026, CBAM will be phased in for carbon-intensive goods such as steel, aluminum, cement, fertilizers, electricity, and hydrogen, while free emission allowances will be fully phased out by 2034. During the transition period, importers must report embedded emissions for these products, and from 2026 onward, both reporting and the purchase of CBAM certificates will become mandatory.

The U.S. Securities and Exchange Commission (SEC) released a draft climate-risk disclosure rule in March 2022, with phased implementation beginning in 2024 based on company size. The rule requires publicly listed companies to disclose climate-related governance, risk-management practices, and greenhouse-gas emissions indicators (Scopes 1, 2, and in some cases 3), providing transparent information on how climate change affects their operations. Firms must also report how their boards and executives assess and manage climate risks, including target-setting and oversight mechanisms.

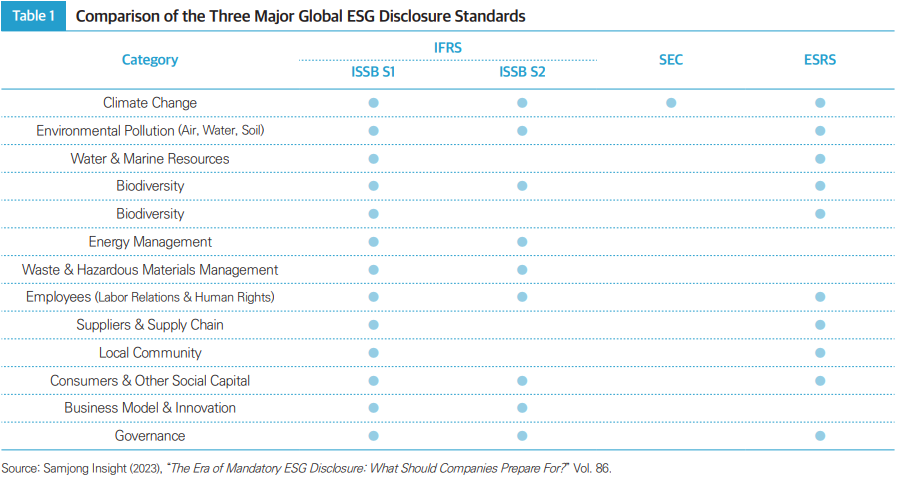

ESG disclosures have formed a complex ecosystem driven by numerous standard-setting bodies and initiatives, making it difficult for companies to provide consistent and reliable information. Beyond sustainability reports, expanding disclosure obligations are increasing the administrative burden on firms and reducing the comparability of reported information. As a result, mandatory reporting, standardization, and interoperability have emerged as key priorities,

and regulators are developing national disclosure frameworks accordingly. Major global ESG disclosure standards include those of the ISSB, SEC, and EFRAG, and Korea also introduced climate-focused sustainability disclosure standards through the KSSB in April 2024.

"As a result, mandatory reporting, standardization, and interoperability have emerged as key priorities, and regulators are developing national disclosure frameworks accordingly."

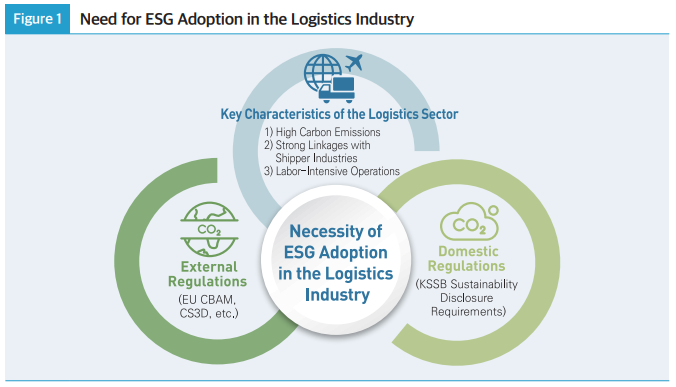

03. Need for ESG Adoption in the Logistics Industry

As global expectations for climate action and social responsibility grow, logistics companies increasingly need to adopt ESG management practices. As a high carbon-emitting sector, the logistics industry must reduce emissions through measures such as adopting ecofriendlyvehicles, improving energy efficiency, and using alternative fuels. Its laborintensive nature also makes safe working conditions and the protection of worker rights essential. Failure to meet the ESG expectations of shippers risks exclusion from supply chains, making it critical for logistics firms to ensure supply-chain sustainability.

Internationally, the introduction of the EU’s Carbon Border Adjustment Mechanism (CBAM) and Corporate Sustainability Due Diligence Directive (CSDDD) is strengthening ESG obligations for logistics companies. CBAM requires logistics companies to manage and report emissions associated with transported goods, and emissions generated during logistics activities may also fall under its scope. CSDDD expands human-rights and environmental responsibilities across entire supply chains, emphasizing the environmental and social duties of logistics firms and increasing the importance of managing partner companies. In Korea, ESG disclosure will become mandatory from 2025 for listed companies with assets exceeding KRW 2 trillion. In particular, logistics companies are

expected to measure greenhouse-gas emissions, develop climate-response strategies, and assess climate-related risks and opportunities. These regulations increase pressure on logistics firms to pursue ESG management as a means to achieve sustainable growth and strengthen international competitiveness. This underscores the need for a sector-wide ESG management system and strategic investment planning across the logistics industry. Given these dynamics, the government must also develop policy measures to support ESG adoption within the logistics sector.

"In particular, logistics companies are expected to measure greenhouse-gas emissions, develop climate-response strategies, and assess climaterelated risks and opportunities."

04. Findings on ESG Impacts and Priority Analysis

Analysis of ESG activities in logistics firms shows that large companies and those with overseas operations perceive ESG as more important compared to small and mediumsized enterprises. This highlights a clear awareness gap between large and smaller firms, and companies active in overseas markets view ESG adoption as essential to comply with increasingly stringent international regulations, particularly in the EU. In contrast, lower ESG awareness among small logistics firms may lead to insufficient supply-chain risk management, potentially harming the reputation and performance of larger companies they serve. This underscores the need for targeted policy support for SMEs, including ESG training, financial assistance, and incentive programs.

The impact assessment revealed that environmental (E) initiatives - such as reducing greenhouse-gas emissions and mitigating environmental impacts - positively affect financial outcomes like revenue as well as non-financial outcomes including investor and customer satisfaction. Social (S) initiatives, including human-rights and safety management and sound labor-management relations, also contributed positively to both financial results and non-financial indicators such as community engagement and customer satisfaction. In the governance (G) domain, ethical management, compliance, and transparent governance structures were likewise found to enhance both financial and non-financial performance.

Overall, ESG activities have a positive influence on both financial and non-financial outcomes in logistics firms, suggesting that ESG adoption contributes to long-term performance improvement and sustainable growth. These findings indicate that logistics companies should approach ESG not merely as a regulatory obligation but as an essential component of sustainable business practice. Logistics firms must therefore adopt ESG practices as part of their strategy for long-term, sustainable growth.

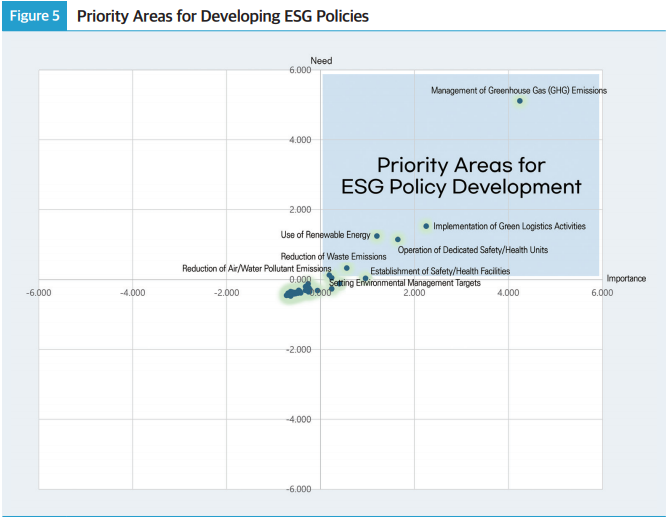

Using AHP analysis combined with policy-need assessments, the top priority areas for logistics ESG policy were identified as GHG emissions management, green-logistics activities, renewable-energy use, safety and health infrastructure, waste reduction, and reductions in air and water pollutants. More than half of these priorities fell within the environmental (E) domain, with the social (S) domain also emerging as a key area of focus. Governance (G), by contrast, showed relatively lower policy urgency. Accordingly, government policy for the logistics sector should prioritize climate-change response and workplace safety and health systems.

Among all factors, GHG emissions management was identified as the most critical policy element and is central to advancing and scaling ESG adoption. Green-logistics measures and renewable-energy utilization must also be emphasized, and policies should acknowledge the growing pressure on logistics firms to meet heightened stakeholder expectations. Government support for safety and health infrastructure is also essential to promoting ESG adoption, particularly to help firms comply with stricter regulations such as the Serious Accidents Punishment Act.

"These findings indicate that logistics companies should approach ESG not merely as a regulatory obligation but as an essential component of sustainable business practice."

05. Legal and Institutional Measures to Strengthen ESG in the Logistics Industry

Based on the Ministry of Trade, Industry and Energy’s K-ESG guidelines, ESG guidelines tailored for logistics enterprises - both large corporations and small and mediumsized firms - were developed. To this end, an ESG framework was designed to reflect the operational characteristics of integrated logistics firms, freight transport operators, warehouse companies, and forwarding firms, encompassing 95 diagnostic items across four domains; Environment (E), Social (S), Governance (G), and Public Disclosure (P). Essential requirements were designated as core items, while additional areas were classified as advanced items to enhance practical flexibility in implementation.

In the environmental domain, additional diagnostic items were included to emphasize emission-intensive transportation activities. In the social domain, items addressing workplace improvements - such as ventilation, temperature, humidity control, and adoption of automation technologies in logistics centers - were added. These additions reflect the need to prevent heat-related worker accidents and enhance safety and environmental conditions in logistics facilities. For warehouse operators, the guidelines emphasize energy efficiency, adoption of green facilities, and reverse logistics initiatives for environmental protection.

For freight transport companies, the guidelines prioritize carbon-emission management and transition to eco-friendly vehicles. Measures to improve working conditions and enhance contributions to local communities were also incorporated. Warehouse-sector guidelines highlight high energy use and carbon-emission management, proposing concrete actions such as installing solar panels, establishing EV charging stations, and expanding the use of eco-friendly packaging. Provisions for improving working conditions within logistics centers to enhance worker safety and welfare were also included. Forwarding firms’ guidelines focus on managing carbon emissions and environmental impacts within supply chains, emphasizing partnership-based strategies to advance sustainable operations. Diagnostic items were also introduced to minimize environmental impacts during maritime and air transport and to support marine environmental protection.

In sum, this study presents ESG guidelines tailored to the characteristics of various logistics sectors and differentiates between basic and advanced items to ensure that SMEs can establish feasible ESG strategies. This approach is expected to support the widespread adoption of ESG management in logistics and promote sustainable growth grounded in environmental and social responsibility.

To effectively advance ESG management in logistics, the government should provide short-term incentives and guidelines for practices such as GHG emissions management, use of eco-friendly packaging, and green-logistics initiatives. Support for installing safety and health facilities and providing related training programs is also necessary. These measures will help establish environmental and safety-management systems within logistics companies and lay a foundation for ESG integration. In the medium term, Scope 3 guidelines should be introduced to strengthen carbon management across entire supply chains, alongside expanded infrastructure support for renewable energy adoption. Introducing an ESG certification framework would allow evaluation of exemplary

companies and the provision of associated incentives. Over the long term, efforts should focus on transitioning to smart green logistics centers, supporting R&D for green logistics technologies, and building smart safety-management systems.

"This study presents ESG guidelines tailored to the characteristics of various logistics sectors and differentiates between basic and advanced items to ensure that SMEs can establish feasible ESG strategies."

The current Framework Act on Logistics primarily addresses eco-friendly logistics and remains limited in its coverage of broader ESG issues. Addressing this requires expanding the concept from “eco-friendly logistics” to “sustainability,” covering not only transport modes but also logistics facilities, while strengthening safety and health components. Mandatory transition to eco-friendly transport modes and expanding the current “Excellent Green Logistics Enterprise” certification into a broader “Excellent Sustainable Logistics Enterprise” scheme are necessary.

ESG-related provisions in the Framework Act are limited to promoting eco-friendly logistics, and ESG considerations are absent from the deliberation and coordination agenda of the National Logistics Policy Committee. Achieving sustainable development in the logistics industry requires a national-level institutional framework that systematically integrates ESG and builds government-led governance structures.

Given that workforce capability in logistics directly translates into ESG competency, incorporating ESG perspectives into logistics workforce development policies is essential. Current logistics training programs and logistics manager certification exams do not include ESG content, highlighting the need for new curricula and training tailored to sustainable logistics. Adding sustainable logistics and ESG topics to certification exams and offering practical ESG training through collaboration between firms and educational institutions would help build necessary competencies. Such programs will enable logistics workers to

acquire and apply ESG principles.

The government should amend the Framework Act to explicitly incorporate ESG training within workforce development provisions and expand financial and administrative support for relevant institutions and firms. Universities and training institutions should develop curricula integrating ESG and logistics, while online learning platforms should be utilized to enhance accessibility. By revising certification exam subjects to assess practical ESGmanagement skills, the logistics industry can significantly strengthen its ESG capacity and advance sustainable development.

[ References ]

Korea Logistics Industry Promotion Foundation. (2022). ESG Handbook.

Korea Logistics Industry Promotion Foundation. (2023). ESG Management Guidebook for Small and Medium-Sized Logistics Companies.

Framework Act on Logistics Policy, Act No. 19986 (Enacted July 10, 2024).

Park, J. (2019). ESG Performance Assessment Practices in Major Countries and Policy Implications. Korea Institute for International Economic Policy.

Ministry of Trade, Industry and Energy. (2023). Sector-Specific K-ESG Guidelines.

Ministry of Trade, Industry and Energy. (2023). K-ESG Guidelines v1.0.

Samjong KPMG Economic Research Institute. (2023). Preparing for Mandatory ESG Disclosure: What Should Companies Do? (Vol. 86).

Jipyung ESG Center. (2022). New Environmental ESG Laws and Regulations Effective from 2022. Jipyung LLC Newsletter.

Korea Institute of ESG Standards. (2023). ESG Evaluation Methodology.

Bruna, M. G., Loprevite, S., Raucci, D., Ricca, B., & Rupo, D. (2022). Investigating the marginal impact of ESG results on corporate financial performance. Finance Research Letters, 47, 102828.

Hwang, B., et al. (2021). Does it pay to deliver superior ESG performance? Evidence from US S&P 500 companies. Journal of Global Responsibility, 13(4), 421-449.

Nirino, N., Santoro, G., Miglietta, N., & Quaglia, R. (2021). Corporate controversies and company financial performance: Exploring the moderating role of ESG practices. Technological Forecasting and Social Change, 162, 120341.

Park, S. R., & Jang, J. Y. (2021). The impact of ESG management on investment decisions: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies, 9(3), 48.

GRI (2022). “Four-in-five largest global companies report with GRI.”, https://www.globalreporting.org/news/news-center/four-in-five-largestglobal-companies-report-with-gri

TCFD. “Introduction to the recommendations.”, https://www.tcfdhub.org/introduction

UN Global Compact. “The Ten Principles of the UN Global Compact.”, https://unglobalcompact.org/what-is-gc/mission/principles

UN Sustainable Development. “The 17 Goals.”, https://sdgs.un.org/goals

01. Study Overview

02. Domestic and International ESG Regulatory Landscape

03. Need for ESG Adoption in the Logistics Industry

04. Findings on ESG Impacts and Priority Analysis

05. Legal and Institutional Measures to Strengthen ESG in the Logistics Industry

02. Domestic and International ESG Regulatory Landscape

03. Need for ESG Adoption in the Logistics Industry

04. Findings on ESG Impacts and Priority Analysis

05. Legal and Institutional Measures to Strengthen ESG in the Logistics Industry