Card News

NEWS

KOTI - Korea Transport institute-

What is the prospect of the waste electric vehicle batteries recycling market?

# In the first half year of 2022, the investigation showed there are 4.3 million new electric vehicle sales in worldwide.

Therefore, as the supply of electric vehicles increases, the market for used batteries for electric vehicles is also rapidly growing.

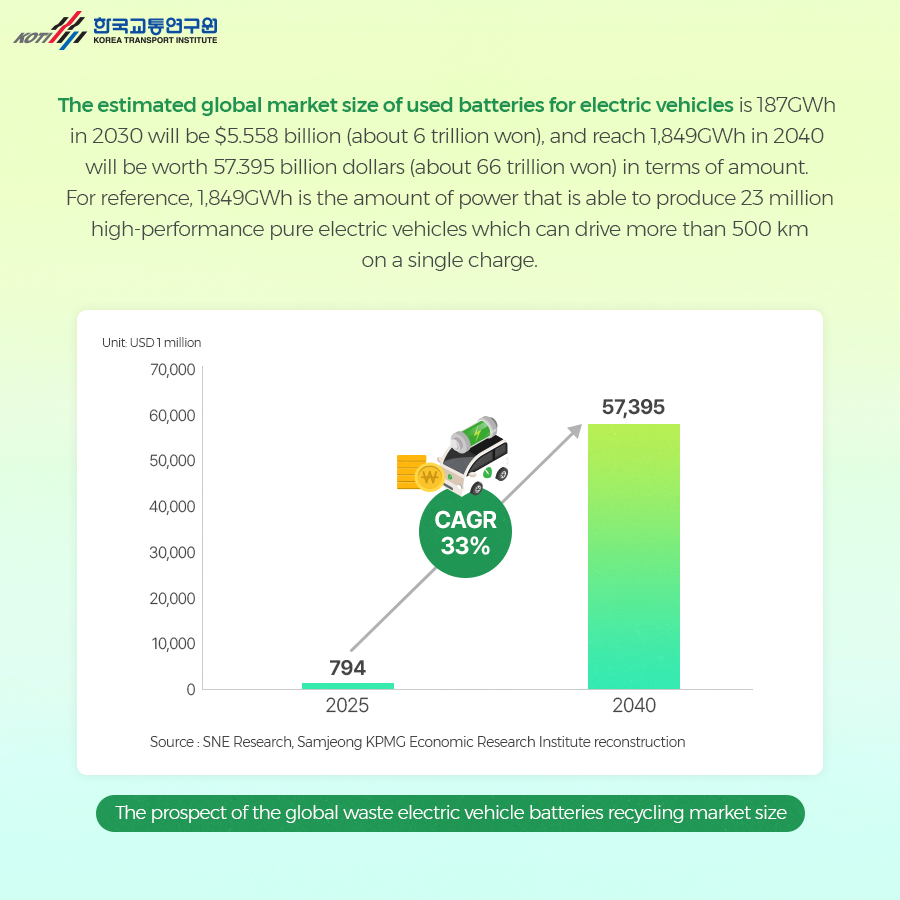

# The estimated global market size of used batteries for electric vehicles is 187GWh in 2030 will be $5.558 billion (about 6 trillion won), and reach 1,849GWh in 2040 will be worth 57.395 billion dollars (about 66 trillion won) in terms of amount.

For reference, 1,849GWh is the amount of power that is able to produce 23 million high-performance pure electric vehicles which can drive more than 500 km on a single charge.

The prospect of the global waste electric vehicle batteries recycling market size / Unit: USD 1 million / SNE Research, Samjeong KPMG Economic Research Institute reconstruction

# Therefore, the increase in the number of electric vehicles supplied is driving not only the growth of the electric vehicle market but also the growth of the used batteries market. The importance of carbon neutrality and circular economy is emphasized, and the used batteries recycling market is expected to accelerate further.

Electric vehicle production and waste batteries occurrence / Division / US / Japan / China / Korea / Electric vehicle (units) sales rate in 2021 / waste battery (ton) / waste weight / waste battery / 8 million in 2040 / 40 thousands in 2020 / Source: The author editing of the “ev volumes” data from Korea International Trade Association

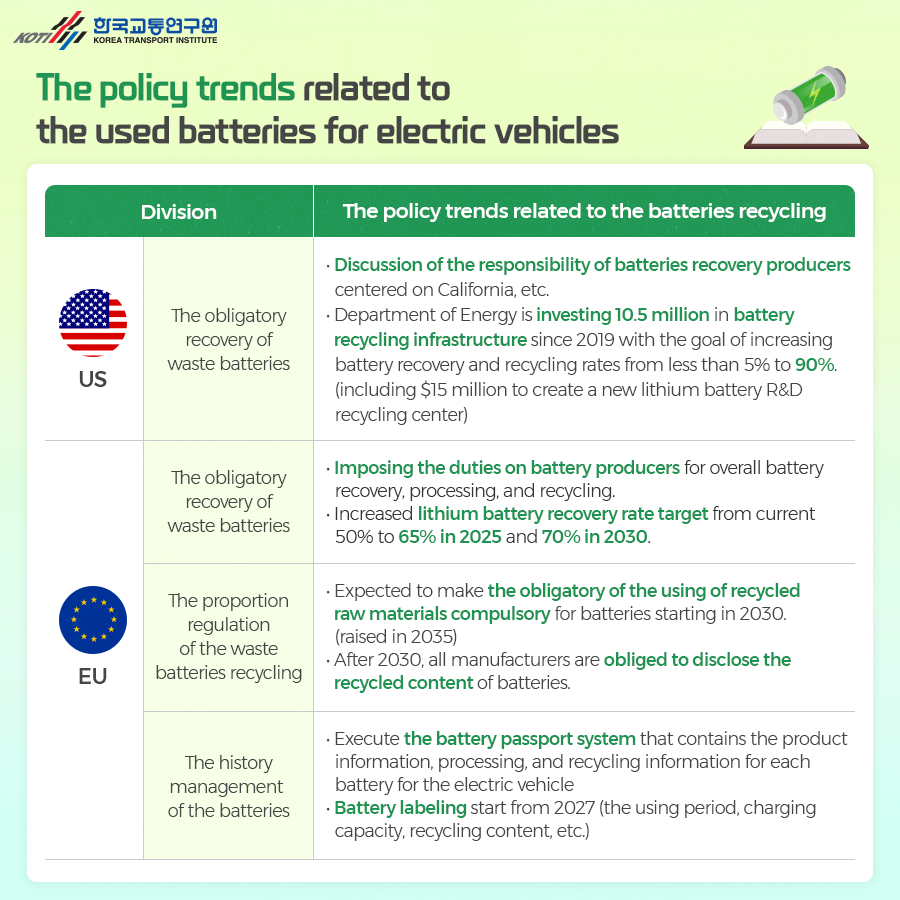

# The policy trends related to the used batteries for electric vehicles / The policy trends related to the batteries recycling / The obligatory recovery of waste batteries / The proportion regulation of the waste batteries recycling / The history management of the batteries / Standardization of all stages of recycling

Discussion of the responsibility of batteries recovery producers centered on California, etc.

Department of Energy is investing 10.5 million in battery recycling infrastructure since 2019 with the goal of increasing battery recovery and recycling rates from less than 5% to 90%. (including $15 million to create a new lithium battery R&D recycling center)

Imposing the duties on battery producers for overall battery recovery, processing, and recycling. / Increased lithium battery recovery rate target from current 50% to 65% in 2025 and 70% in 2030.

Expected to make the obligatory of the using of recycled raw materials compulsory for batteries starting in 2030. (raised in 2035) / After 2030, all manufacturers are obliged to disclose the recycled content of batteries.

Execute the battery passport system that contains the product information, processing, and recycling information for each battery for the electric vehicle / Battery labeling start from 2027 (the using period, charging capacity, recycling content, etc.)

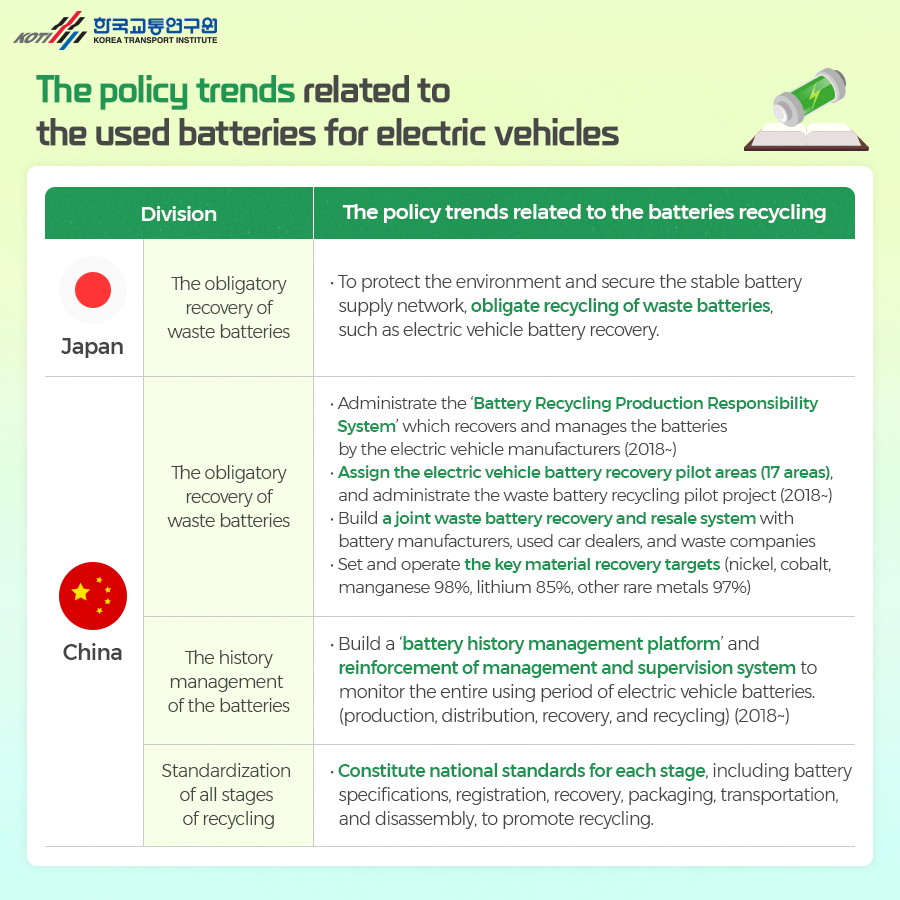

# To protect the environment and secure the stable battery supply network, obligate recycling of waste batteries, such as electric vehicle battery recovery.

Administrate the ‘Battery Recycling Production Responsibility System’ which recovers and manages the batteries by the electric vehicle manufacturers (2018~) / Assign the electric vehicle battery recovery pilot areas (17 areas), and administrate the waste battery recycling pilot project (2018~) / Build a joint waste battery recovery and resale system with battery manufacturers, used car dealers, and waste companies / Set and operate the key material recovery targets (nickel, cobalt, manganese 98%, lithium 85%, other rare metals 97%)

Build a ‘battery history management platform’ and reinforcement of management and supervision system to monitor the entire using period of electric vehicle batteries. (production, distribution, recovery, and recycling) (2018~) / Constitute national standards for each stage, including battery specifications, registration, recovery, packaging, transportation, and disassembly, to promote recycling.

# The policy trends related to the used batteries for electric vehicles

In Korea, the six bright prospects leading the Green New Deal have been included in the “services related to electric vehicle batteries” in 2020. And In 2021, by announcing the K-Battery development strategy, we are working hard to establish a foundation for related laws, systems, and develop the technology.

In 2025, the ‘used electric vehicle battery resource recycling cluster’ will be created in Pohang to support the development and demonstration of used battery recycling technology, and the number of used secondary battery industrialization centers increased from the current two to four.

# The industry trends related to the used batteries for electric vehicles

A representative utilization method of the used batteries for the electric vehicle, different from the originally designed use of the battery for another purpose or use is called the “change the use”. “Reuse” means a battery is reused directly for the purpose for which it was made. “Recycling” means the batteries are disassembled after use and rare metals are extracted through wet and dry smelting and recycled as battery materials.

The used battery recycling business models can be largely classified into battery manufacturers, battery material companies, battery recycling companies, and other companies.

In the case of battery manufacturers leading the recycling business model, it has strengths in battery recovery and processing, and it is possible to reduce battery production costs due to high bargaining power in upstream raw materials.

# Representatively, CATL which is currently the No. 1 company in the global battery market took over Guangdong Bangpu which has battery recycling technology in 2013. Then invested 6 trillion won in a battery manufacturing industrial complex project to build a comprehensive production base with the ability to recycle batteries from raw materials to used batteries.

As electric vehicles become popular, the electric vehicle waste battery industry will grow.

Waste batteries contain valuable materials that can be reused, and reducing dependence on new resources.

While minimizing environmental impact by adopting a circular economy approach, economic opportunities are expected to create.

* The card news was produced after partially correcting and supplementing by the Korea Transport Institute KOTI Mobility Conversion Brief Vol.1 No.3 ‘The policy and industry trends related to the used batteries for electric vehicles’.